AIG Life Term Assurance

AIG Life has enhanced its Term Assurance product to help individuals cover their Inheritance Tax (IHT) liabilities.

Its new Joint Life Second Death (JLSD) option is a cost-effective alternative to whole of life insurance for couples who plan to gift assets away and so erode their IHT liability.

There is also an option which allows customers to carve out a gift inter vivos plan from the existing sum insured, without the need for further health or lifestyle questions, in order to cover the reducing IHT liability on any gifts made over the term of the insurance.

AIG has also reduced the minimum term to two years to meet the needs of individuals investing in Business Relief-qualifying schemes. These are free of IHT after being held for two years but fully liable in the meantime. The two-year term is also available on a JLSD basis for joint applicants.

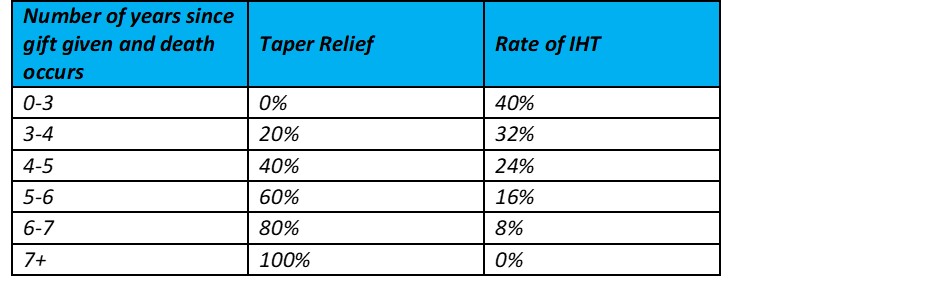

Comment: Assets are subject to Inheritance Tax at a reducing rate from 40% to 0% over seven years when gifted to an individual.

So, it can be very tax efficient to gift assets during one’s lifetime. Not everyone chooses to do so but, if they do, the conventional route of having a whole life policy to cover the prospective IHT bill on death can prove to be an expensive solution. That in turn may well stop an older person from buying a policy for this purpose.

AIG’s gift inter vivos structure allows customers to buy additional Term Assurance policies lasting 3, 4, 5, 6 and 7 years, each worth 20% of the IHT liability. That is, the amount someone might have to pay in IHT if they die that year. If the insured person dies within the seven years, the insurance benefit can be used to cover the IHT liability, provided the policy is written in trust.

Shares in qualifying businesses – such as private companies not listed on a stock exchange or firms listed on the Alternative Investment Market (AIM) – attract 100% Business Relief providing they have been held for at least two years at the time of death. If the shareholder dies within that two years and the value of their estate is more than the IHT nil-rate band, the investment is subject to 40% tax. This plan can now cover that potential liability.

The changes won’t radically change the use of life insurance in tax planning, but they are a good example of an insurer that has listened to the needs of its customers and adapted its term plan to best fit with those taking advantage of these two established tax planning routes.

Plus points: Changes to AIG’s existing term plan to meet certain tax planning options; Simple changes; May encourage more use of life insurance in IHT planning.

Not so plus points: Relatively limited market.

Website: http://www.aiglife.co.uk.

Rating (max 10): Innovation: 8. Overall: 8. Gold

Tags: Term; AIG Life