Sun Life Funeral Plan

Michael Parkinson has long been the UK’s most successful life insurance salesman – heading up Sun Life’s D2C TV advertising campaign for its over 50s guaranteed acceptance life insurance plan. It is interesting that an industry that is not widely trusted by the public chooses to use one of the most trusted public figures to promote its plans – and highly successful that approach has been too.

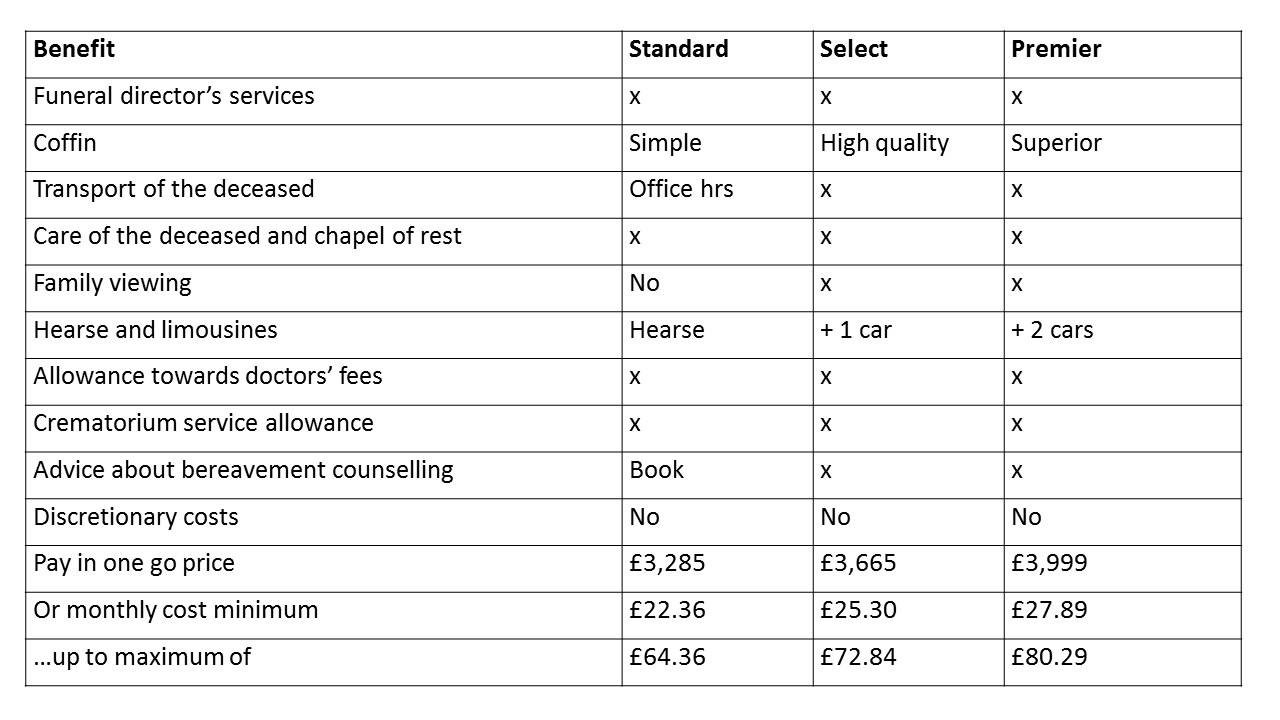

Now, Sun Life has launched a funeral plan alongside its Over 50s whole of life plan. The plan, which is underwritten by AXA Wealth, offers a choice of three cover levels and can be paid for upfront or monthly, with the price dependent on age. The three plan options are:

Benefits are paid to Golden Charter, which then arranges the funeral through one of its funeral directors. As with most other guaranteed acceptance life plans, the full sum insured is payable on death after two years if premiums are paid monthly, or immediately if the death was accidental. On death during that two year period from non-accidental causes, 120% of premiums paid are passed on to Golden Charter towards the funeral costs. The scheme’s age range is 50-80 at outset and the life policy is a whole of life plan, with guaranteed premiums.

Comment: This is a logical extension for AXA, which notes that the average cost of a funeral is now £3,456. As well as paying for (most of) these costs, this plan also provides a set level of benefits, making the process easier for a grieving family, who will doubtless be pleased that the deceased had already taken most of the key decisions about how their death should be managed. Of course, this scheme won’t suit everyone, and customers are ‘locked-in’ to one funeral provider – although there are get out options too.

The big downside of the regular monthly plan is that it uses the over 50’s plan model that provides great value for those who live just a few years but can offer very poor value for those who ‘live too long’. For many people a non-insured funeral plan linked with a fully underwritten whole of life plan may be a better option, albeit one that is more complex and uncertain in some ways.

Plus points: A simple funeral scheme with choice of lump sum or monthly insurance premium options; Linked to Golden Charter (the UK’s largest independent funeral plan provider); Get out options if another type of funeral is preferred later.

Not so plus points: Paying monthly can prove very expensive if the customer lives too long; Does not cover all funeral costs; The customer may have different funeral requirements later on.

Website: http://www.sunlifedirect.co.uk.

Rating (max 10): Innovation: 6. Overall: 6. Bronze

Tags: Sun Life; WL